“What can really happen, right?”

“What can really happen, right?”

Did you ask yourself this question when you started considering travel insurance coverage?

You face several risks when you travel. Some are small, like having a rainy beach day or leaving an umbrella in a cab.

Others are big, like a costly cancelled trip or getting sick abroad.

Planning a trip means pre-paid expenses like plane tickets, cruise fare, or tour packages.

These expenses are at risk if you need to cancel, but you also risk additional expenses from medical emergencies while traveling.

Here are 7 “Real Life” examples of the risks you face when you travel:

1. Someone gets sick and you need to cancel your trip… losing your entire vacation investment

The family cruise on Disney departs in a few days.

Your 8 year old daughter catches the flu and has a 103 fever. Her doctor recommends that she not travel, so you need to cancel the trip.

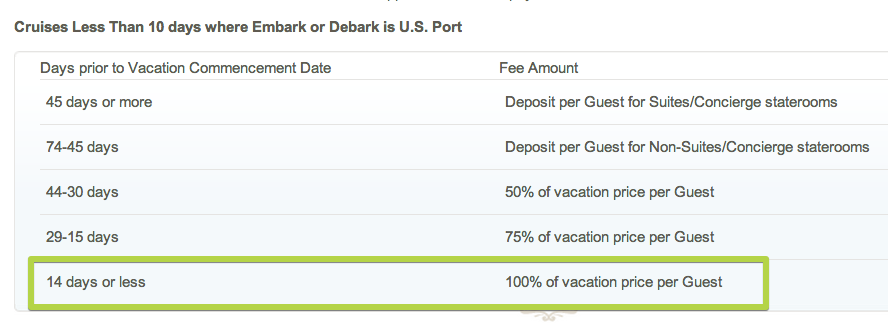

Getting sick within 2 weeks of departure will cost you 100%

Disney offers no refund for cruise cancellations less than 14 days before the trip.

You lose the full cost of the trip, totalling almost $8,000 in pre-paid cash.

2. A hurricane damages your resort and you need to cancel

You’ve planned the perfect trip to Cancun.

Plane tickets, all-inclusive resort, a charter boat for fishing. You have invested over $4,000.

The day before you are supposed to leave a hurricane hits the island and renders your resort uninhabitable… the hotel has serious damage and the whole area is in shambles.

You lose your $4,000. How will you afford to re-book your vacation?

3. A family emergency cuts your vacation short and you lose the remaining travel arrangements

Your family just started a two week tour of Italy.

Two days into the trip, your father suffers a heart attack and is in critical condition.

You want to get home as soon as possible to see him, so you call off the rest of the trip and buy tickets on the first plane back home. Your father pulls through after two weeks in the hospital which is excellent news.

What happens to the Italy trip? You would have losses such as:

- Pre-paid expenses you didn’t get to use for rest of the trip

- Cost of the last-minute plane tickets to get home

- The expense of re-joining the trip if you are able to

You lose almost $11,000… and it could be a while before you can afford to go again.

4. A visit to a foreign hospital leaves you with a big bill

Your family trip to Switzerland is finally underway.

Your husband is struck by a taxi while crossing the street. He needs immediate care and is taken to the closest hospital where he is treated for internal bleeding and spends 2 nights.

Upon checking out, you are given a bill for the hospital expenses.

Your health insurance from home doesn’t travel with you, so you are stuck with paying the bill.

5. A medical airlift leaves you with a crippling debt

A hiking trip to Chile has quickly turned for the worse.

You slip on a rock and suffer fractures in both legs and a punctured lung. The nearest hospital is completely inadequate to treat you properly so you need to be airlifted 200 miles.

Your injuries are not life threatening and you receive a week of treatment. You are ready to check out of the hospital and get back home.

The bill for the emergency helicopter airlift totals over $45,000, which you need to pay somehow.

Plus, you are in double casts and need a nurse to accompany you home on a special medical flight, which will cost another $12,000.

6. An emergency abroad leaves you looking for a ‘lifeline’

Who do you call if there’s an accident abroad?

How do you locate a hospital? How do you arrange an ambulance, medical payments, or transportation home after receiving care?

What if you don’t speak the language…how do you know you are getting the best care?

How do you replace a missing passport or lost credit cards?

7. Stolen luggage leaves you without your prescription medications

Airlines lose bags, bags get stolen, and bags get damaged.

What if you lose your baggage and all the contents? How much would it cost to replace it?

And what if your prescription medications were inside…how do you get a replacement?

You need peace of mind, protection against the unexpected, and you don’t want to lose your money

The list above only mentioned the common risks travelers face, but there are many more that we will discuss in this tutorial.

Next in the series:

In the next part, What does travel insurance cover?, you’ll see how the right coverage can protect your vacation investment, your health, and safety.

Go back to the Travel Insurance 101 series.