Editor Review of Travel Insurance Services

The Good: Most plans are offered in multiple levels, so travelers can choose from a number of useful policies to meet their unique needs. Travel Insurance Services offers a good number of package plans, and a wide range of travel medical and travel accident plans – including plans for corporate employees. Plan pricing is easy to understand and find.

The Drawbacks: Travel Insurance Services specializes in travel medical plans. Their coverage for emergency dental care is limited.

The Bottom Line: A pioneer in the international medical field, Travel Insurance Services was one of the first companies to develop travel insurance products. They have added consumer-friendly package plans over the years, and while they offer some good package plans, they remain focused on travel medical. As a result, they also have a number of highly specific and well-designed corporate plans to cover traveling executives and employees.

Company Information

Company Name | |

|---|---|

| US Travel Insurance Association Member | Yes |

| Refund Policy | 10-day Free Look Period |

| Travel Insurance Plans | Package plans Select Basic Select Plus Select Elite Travel medical plans InterMedical Insurance WorldMed Insurance Visit USA HealthCare Insurance Study USA HealthCare Voyager Annual Worldwide Group Protector Travel accident plans High Limit Accident Insurance USI Assist Employee Travel Protection Specialty plans World Risk Portfolio |

| Company Contact Information | Travel Insurance Services 2950 Camino Diablo, Suite 300 Walnut Creek, CA 94597-3991 1-800-937-1387 (8:30am-5pm Pacific Time M-F) 610-537-9835 Fax info@travelinsure.com |

| Policyholder Questions | 1-866-346-1803 |

| Travel Assistance/Emergencies | Inside US/Canada: 1-866-346-1803 (toll free) Outside US/Canada: call operator & connect to 1-715-342-3541 (no charge) |

About Travel Insurance Services

Travel Insurance Services (branded travelinsure.com) serves individuals, groups, and corporations as they travel or send employees out into the world. Their website is international-friendly with Chinese versions of content.

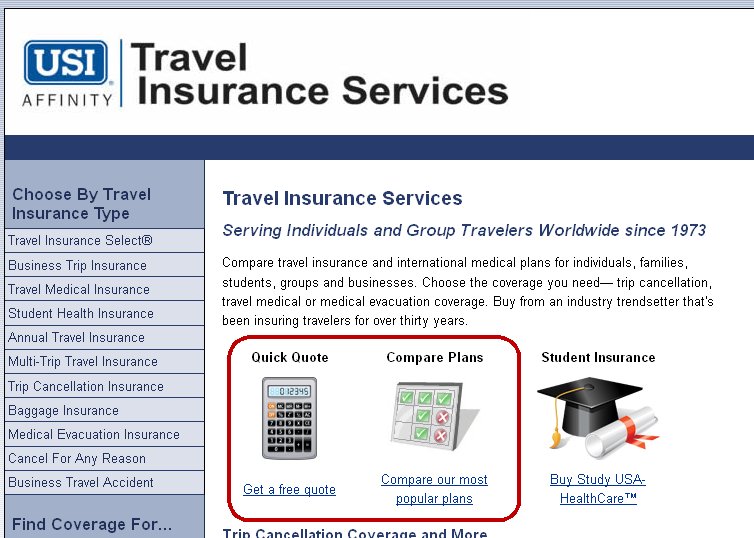

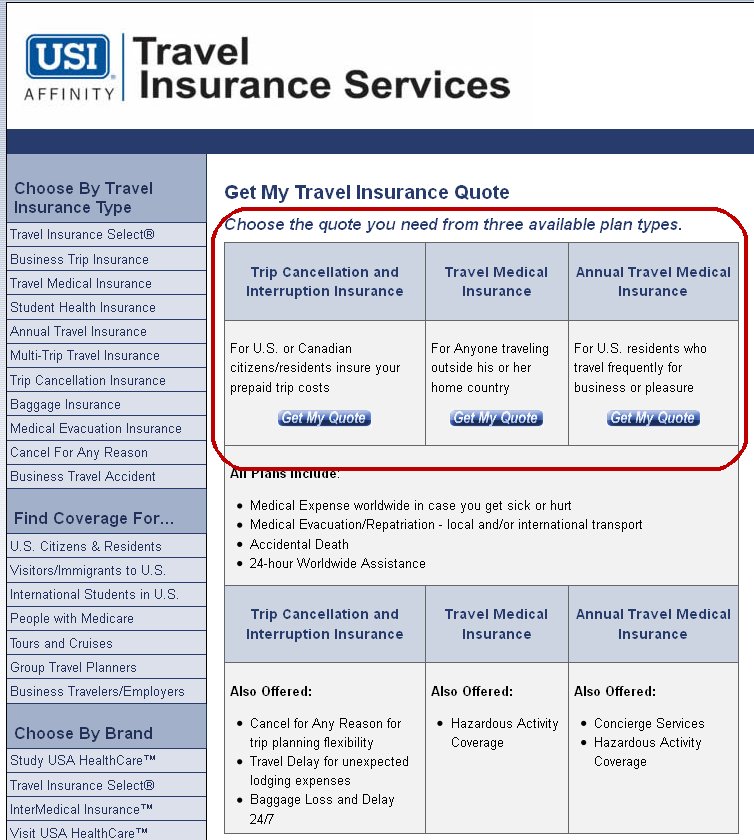

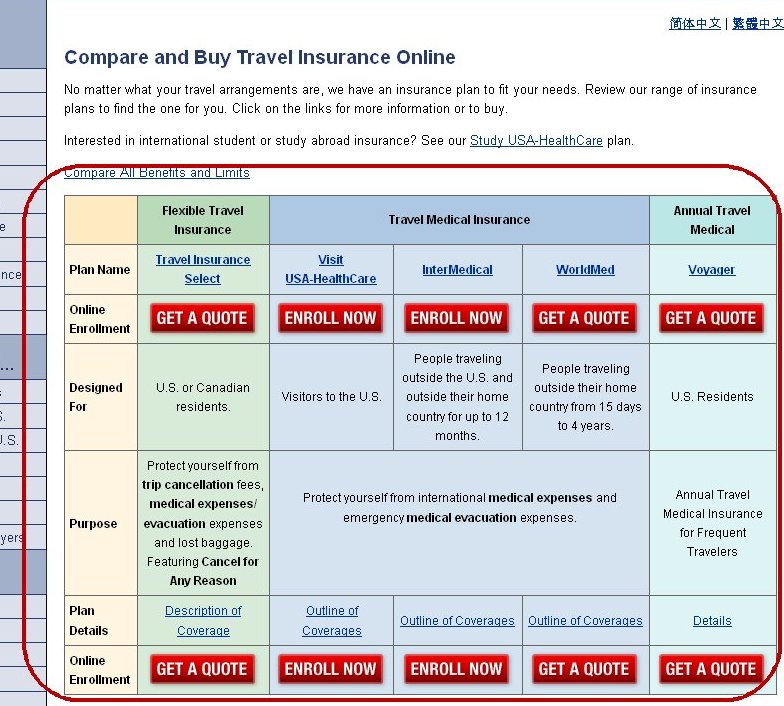

From the Travel Insurance Services website, you can get quick quotes, compare plans, and purchase most plans immediately. Pricing is made clear right up front, as well as descriptions of coverage, and more. Their site also includes the ability to obtain claim forms and submit feedback. Information is broken down into travel insurance types, coverage for specific trips, and brand. They offer a range of package plans and travel medical plans, including plans for students, seniors, visitors to the U.S., and corporate employees and executives.

Travel Insurance Services also offers customized group plans for groups of over 100 or for groups with plans to travel for longer than 6 months or on a regular basis. If these conditions apply to your group, Travel Insurance Services will tailor a custom annual plan to meet your specific needs for international travel medical, evacuation, AD&D, repatriation, travel assistance services and more.

Optional Coverage Available in Travel Insurance Services Plans

- ‘Cancel for any reason’ is available in some plans for up to 75% of your trip cost reimbursement.

- Purchase your plan within 15 days of initial trip deposit for automatic pre-existing medical condition coverage.

- Optional adventure and hazardous sports upgrades available for some plans.

Highlights of Travel Insurance Services Travel Insurance

- Travel Insurance Services offers a range of corporate plans to protect employees and the corporation from financial loss.

- Dental and vision discount plan can be purchased separately from any of the Travel Insurance Services plans.

- Plan premiums are easy to understand and easily available right on the plan description pages.

- Custom group plans can be designed for corporations and organizations who need coverage for their employees and members.

Travel Insurance Services plans

Select Basic

Basic coverage for the traveler staying relatively close to home and on a budget

This is basic travel insurance that covers the essential risks of travel. It offers excellent pricing options for trips longer than 30 days and up to 365 days. Excellent for healthy travelers taking general vacations and trips.

Select Plus

Quality travel insurance with adequate limits and early purchase options at no extra cost

This is quality travel insurance that covers all the essential travel risks and provides coverage for pre-existing medical conditions and supplier financial default in the base plan if purchased early (within 15 days of initial trip deposit).

Select Elite

A high-end coverage plan with excellent limits and primary medical coverage

With high coverage limits and early purchase options at no extra cost, this plan is ideal for expensive and/or longer trips due to the excellent pricing options for trips lasting longer than 30 days and up to 365. Medical and evacuation limits to cover just about any travel medical emergency.

Travel Medical Plans

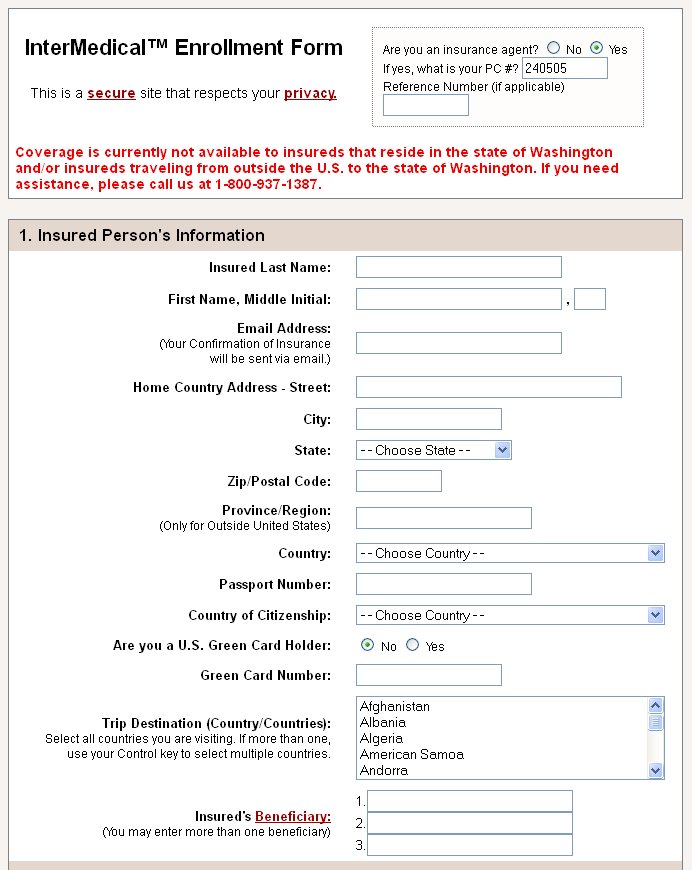

InterMedical Insurance

Low cost international medical insurance for single trips – covers families too

This is single-trip coverage for U.S. citizens traveling outside their home country for up to one year. Choose from two plan levels, and round out the coverage with additional AD&D if necessary. Travel assistance services are included. This plan meets Schengen Visa requirements for European travel and is available to corporations and individuals.

WorldMed™ Insurance

Flexible, renewable international medical insurance for those traveling abroad

Choose the medical and evacuation limits to meet your needs and your budget. This is single-trip insurance for trips from 15 days up to 4 years, and it includes some excellent package-like benefits that ease the difficulties of travel. Offered at three plan levels with your choice of deductible.

Voyager Insurance

Good travel medical coverage on an annual basis for the frequent traveler

This plan covers any number of trips throughout the year. Choose a combined medical and evacuation plan or a standalone evacuation plan. Options for hazardous activities available. This plan is ideal for U.S. citizens who often travel outside their home health insurance network.

Study USA HealthcCare Insurance

Affordable international health insurance for students under age 64 traveling for study

Offered in two plan limits, this is basic international medical coverage for U.S. and non U.S. citizens studying abroad. Coverage for spouse and children is available. This plan is designed to meet or exceed university and study-abroad programs.

Visit USA HealthCare Insurance

Strong medical coverage for non U.S. citizens traveling inside the U.S.

This is single-trip coverage for those under age 70 who are traveling to the U.S. for leisure or business. Your choice of medical, evacuation, and accident limits as well as the deductible amount. Hazardous activities can also be covered. Trips from 15 days up to one full year for international travelers.

Worldwide Group Protector

Low cost medical insurance for groups traveling abroad – weekly rates

The affordable answer to group medical protection, this plan gives you a choice of benefit limits for complete coverage at low weekly rates. Ideal for tour groups, church groups, and exchange groups, this plan covers individuals and families for medical care, evacuations, repatriation and more.

Travel Accident Plans

High Limit Accident Insurance

A simple, easy-to-understand, term AD&D plan for high benefit limits

Ideal for those who want a little extra term life and disability protection to cover sudden losses. Premium amounts depend on the coverage limit and selected countries, but are not made immediately clear on the Travel Insurance Services website. After you fill out the application, the premiums are revealed.

USI Assist

Employer-sponsored travel accident coverage with a few options for added security

Offered at three different levels, this plan covers full-, part-, and temporary employees of a participating organization, including their spouse and children if traveling with the employee. This plan covers travel accidents and emergency medical evacuations in the base plan. Options for security evacuations and out-of-network medical expenses can be added.

Employee Travel Protection

A low-cost enhancement to benefit packages – employer-sponsored travel accident protection

Offered at three different plan levels, this plan provides employer-sponsored employee travel accident protection for firms of 3 to 100 employees. Rates are based on the amount of employee travel and are very affordable. This plan covers travel accidents, illnesses, emergency medical evacuations, and repatriation in the base plan for employees traveling 100 or more miles away from home on a regular or minimal basis.

Specialty Plans

World Risk Portfolio

Combining multiple products for kidnap and ransom, commercial liability, and more

This is a highly customized plan designed for U.S. and Canadian companies who do do business in foreign countries. Intended to protect employees and the organization from financial losses, it provides high limits for medical care, commercial liability, business auto liability, worker’s compensation, political risk, and more.

Screenshots of Travel Insurance Services Website