This page is all about travel insurance reviews. You’ll learn about the best companies, plans, and recommendations for different types of travelers. You will also learn how to choose a travel insurance company, how to get a quote, and see all the frequently asked questions.

Before we get to the trip insurance reviews…

Quick overview of travel insurance

Travel insurance protects your money if you need to cancel a trip for an unexpected reason.

For example: You paid for a cruise with the family, but a few days before departing your daughter gets the flu with a 103 temperature. Your doctor recommends you cancel the trip.

Without insurance– you cancel the trip and are at the mercy of the cruise line’s cancellation policy (which are notoriously bad). You lose all the money you already spent.

With insurance– you cancel the trip and get back all the money you spent. Your daughter rests and gets better, and you can start planning a make-up trip with the reimbursement check.

With our travel insurance reviews, you will be able to find the best plan for your trip.

Travel insurance covers cancellations due to:

- Hurricane/weather

- Illness or injury of family member

- Death of a family member

- Terrorism

- Loss of passport

- Jury duty

- and more…

Travel insurance also covers:

- Interrupted trips

- Travel delays

- Lost baggage

- Delayed baggage

- Medical emergencies

- Emergency evacuations

- 24/7 assistance

- and more…

Travel insurance comes in 2 basic types:

Comprehensive Trip Insurance (Most Popular) covers the items above: cancellations/interruptions, delays, baggage, medical, evacuation, etc. This is what most travelers get to protect their trip.

Travel Medical Insurance covers medical emergencies while outside your home country. It also covers medical evacuations. This is most popular for business travelers, expats, students, and other long-term travelers.

Method for our Travel Insurance Reviews

Insurance is a tricky product to review.

By design, insurance is something you buy that you do not want to use. If you need to use it, that means something bad happened. You buy it when you are worried something might happen.

You buy it to lower your risk, protect your money, and keep your family safe.

So, what is the best way to choose a plan?

3 Keys for you to find the best travel insurance:

- You can trust the company: When you buy insurance, you are buying a promise. You pay the insurance company some money, and they promise to pay you for a legitimate claim. If you can’t trust the company, what are you buying?

- You have to coverage you need: You are buying insurance to cover some risks. It might be your pre-paid costs, fancy luggage, or your medical health while abroad. If it doesn’t cover what you want, why are you buying it?

- You don’t waste your money: If you can trust the company, and they have the coverage you want, why pay too much for your plan? Cheap does not mean bad…plenty of great plans with great coverage can be budget-friendly

Let’s talk about each of these travel insurance review factors.

Reputation is a key factor in our travel insurance reviews

Like we said before, insurance is a funny product. The only way to really “review” the product is to file a claim, and that is not feasible for a review like this.

So how do we know if a travel insurance company is reputable?

We do a lot of sleuthing online.

We read reviews from insured travelers on comparison websites like Squaremouth.com, InsureMyTrip.com, and TravelInsurance.com. These reviews can be misleading (see note below), but we gather data from several sources and get an overall picture of the company’s service.

We read ratings from organizations like the Better Business Bureau to see their overall handling of customer complaints. This gives us a picture of how they handle complaints and customer service. We also look at the financial health of the companies from a source called A.M. Best (an insurance company rating firm).

Note: Why we stopped gathering travel insurance reviews

When Travel Insurance Review launched in 2006, we were the first to gather insurance reviews from customers. For years we gathered thousands of customer reviews, had replies from companies, and even helped resolve issues.

But there was a problem. There were only negative reviews. Disgruntled travelers with denied claims were the only people who left reviews. Very few of the many thousands of people with paid claims took the time to leave a review, and it did paint an accurate picture of the reputation of each company.

Travel insurance is a contract between the insured and the insurance company. They define what is covered in the insurance policy. If you have a legitimate claim, it will be paid by all major companies. If they didn’t, they would be shut down.

Travelers who think “everything” is covered become angry when their claim is denied. This is not how insurance works.

Mistakes happen, but insurance companies will fix them. In fact, I have helped travelers with denied claims do this.

The companies that gather reviews solicit them from their clients. When you look at them, you will notice that the majority did not file a claim. They are most helpful when you read and find the reviews for claims. That is what I do with my company reviews.

In the end, we gather a trail of information that leads to the overall reputation of the company.

In addition, our comparison engine only features companies that comply with a Zero-Complaint Guarantee. If you have a complaint about a claim that can’t be resolved, the provider will be removed from our comparison engine.

Coverage and “small print” details are part of our travel insurance reviews

It’s all about the details. If you want your insurance to work for you, it’s all about the details of the policy.

Specifically the travel insurance coverage.

And, not all policies are created equal. Many share similar general coverage, but many companies can stand out because they offer unique things that others don’t.

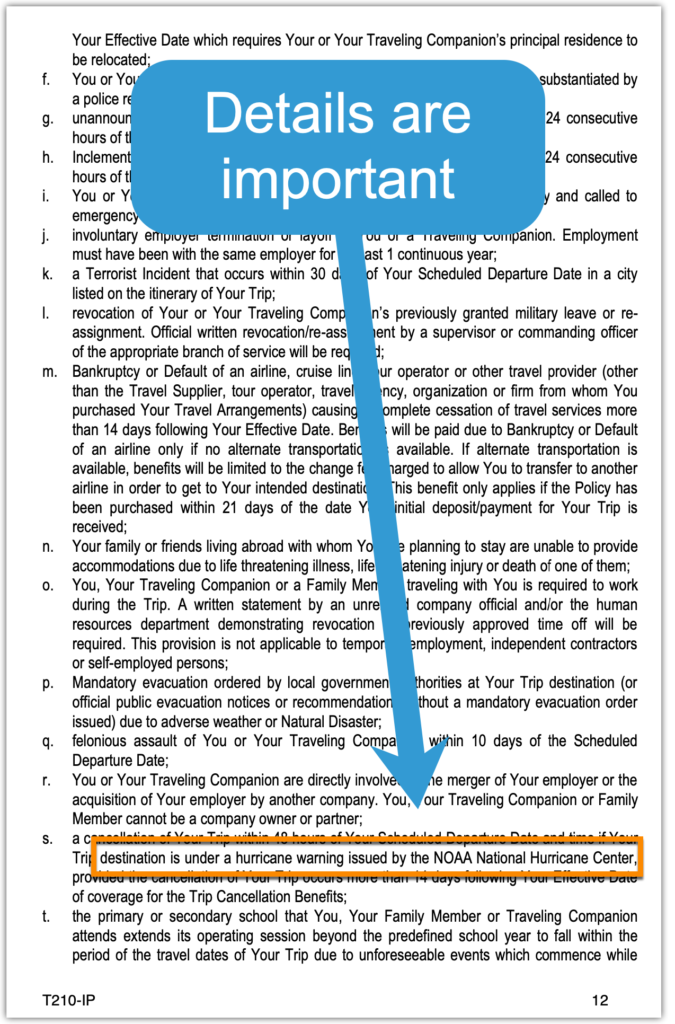

For example, check out this page from a travel insurance policy certificate:

The policy above is from Travel Insured International.

Travel insurance policies are actually very easy to read (as far as insurance documents go). They are not long, and they clearly lay out everything that is covered.

But tucked away inside this plan is an important coverage.

This plan covers hurricane warnings issued by the NOAA, as opposed to just covering actual hurricane damage. This gives you more coverage, and it especially helpful for people traveling during hurricane season.

Not all plans have this. And, this is the kind of stuff we find, and tell you about in our reviews.

The other part of coverage that we consider is the amount of coverage. This is often called the coverage limit, and it shows the maximum amount of money the insurance company will pay for a claim.

Coverage limits vary as well, but with all else being equal you want more coverage. We factor that into our reviews too.

Pricing is the final factor in our travel insurance ratings

Paying more does always not mean getting more.

One of the first questions travelers ask is “How much does travel insurance cost?”.

There are plenty of plans from reputable companies, that have great coverage at a budget-friendly price.

True, there are premium plans that cost 10-15% of the trip cost, but they usually include the expensive upgrades like Cancel For Any Reason insurance coverage.

After we factor in reputation and coverage, we look at price.

The key here is to find the best value plans.

You want a plan from a reputable company, that covers what you want, and a good price. That’s value.

The Best Travel Insurance Companies for 2022

April Highlights

- Innovative company with their “trip cancellation only†plan and their claims process (see next)

- Stress Less Benefits: April’s goal is to handle claims in real-time by paying direct for claims. This is good for you because it means you don’t need to track expenses and file for reimbursement.

- You can cover pre-existing conditions if you purchase within 14 days of initial trip deposit

- Plans: 1)Trip Cancellation Plan is a simple cancellation-only policy, and 2)Choice is a full coverage policy with ample coverage

Arch/RoamRight Highlights

- You can cover pre-existing conditions if you purchase within 14 days of initial trip deposit

- All plans have cancellation coverage for Financial Default

- Cancel For Work Reasons is included with the Elite plan

- All plans have coverage for Non-Medical Evacuation

- Plans: Arch has the Good-Better-Best format of plans with 1)Essential, 2)Preferred, and 3)Elite

Berkshire Hathaway Highlights

- You can cover pre-existing conditions if you purchase within 14 days of initial trip deposit

- Cancel For Work Reasons is included with the ExactCare plan

- No deductible for medical emergencies

- Their Value plan is a great…value! Has good coverage but tends to be lower priced than many plans

- They claim to process claims 5x faster than the industry average, no experience with this but a bold claim

- Plans: 1)ExactCare is their standard plan, and 2)ExactCare Value is their lower priced option that still offers ‘full coverage’.

Generali Highlights

- Trip interruption coverage pays 175% of the trip cost, which is higher than the usual 150%

- Plans tend to be lower priced with higher Medical and Evacuation coverage limits

- However, their plans do not offer coverage for Pre-Existing Conditions, Financial Default, or Cancel For Work Reasons

- Plans: Generali also follows Good-Better-Best plan offering with 1)Standard, 2)Preferred, and 3)Premium

HTH Highlights

- TripProtector Preferred covers 200% for interrupted trips, much higher than the common 150%

- You can cover pre-existing conditions if you purchase within 14 days of initial trip deposit

- They cover Financial Default (except their Economy plan)

- Plans: The same Good-Better-Best format with 1)TripProtector Economy, 2)TripProtector Classic, and 3)TripProtector Preferred

IMG iTravel Insured Highlights

- All plans cover Cancel For Work Reasons if purchased soon enough

- All plans cover Hurricane Warnings if purchased early enough. Hurricane coverage usually required actual damage or cancelled flights, but this expands coverage to NOAA warnings which is great

- Their LX plan offers good ‘luxury’ benefits like covering adventurous activities, rental car damage, non-medical evacuation, Cancel/Interruption For Any Reason. These are usually optional upgrades. Does not, however, cover Pre-Existing conditions.

- Plans: Again, the Good-Better-Best format with 1)Travel Lite, 2)Travel SE, and 3)Travel LX.

Top Pick For:

Travelers taking a ski trip or golf trip will benefit from RoundTrip Elite upgrades

Seven Corners Highlights

- RoundTrip Elite plan offers options that are good for ski (or golf) trip, such as reimbursing for lift tickets of 50% of trails are closed.

- RoundTrip Economy plan is very well priced while offering full coverage.

- Pre-existing conditions can be covered with RoundTrip Elite if purchased early enough.

- Both plans cover Change Fees associated with airline itinerary changes.

- Plans: 1)RoundTrip Economy provides full coverage with lower limits at a lower price, and 2)RoundTrip Elite has more coverage and upgrade options.

TinLeg Highlights

- Luxury plan includes Cancel For Work Reasons coverage

- No deductibles for emergency medical coverage

- Hurricane coverage kicks in after a delay of any length of time, where many policies have a minimum number of hours

- Plans: 1)Economy is a basic plan, and 2)Luxury has more coverage and options

Travel Insured Highlights

- Covers hurricane warnings: Great for hurricane-related travel (during the season or to hurricane-prone areas). They don’t just cover delays or damage from hurricanes, but also NOAA warnings. This greatly increases your coverage.

- Has coverage to pay for the cost of re-booking miles or rewards points if you need to cancel

- Change Fee coverage pays for costs of needing to change itinerary

- Plus plan can cover Interrupt For Any Reason

- Covers non-medical evacuation, such as political unrest, State Dept. issues statement, etc.

- Plans: Good-Better-Best plan selection again with 1)Worldwide Trip Protector Lite, 2)Worldwide Trip Protector, and 3)Worldwide Trip Protector Plus

Travelex Highlights

- Recommended for families because kids 17 and under can be covered at no additional cost…saving you money (see plan page for details)

- Easier choices with 2 plans: Basic and Select

- Plans have Primary medical coverage vs secondary, makes claims process easier

- You are eligible for Pre-existing conditions exclusion waiver if you purchase Travel Select within 15 days of initial trip payment

- Cancel For Work Reasons is included in Travel Select (Travel Basic must purchase within 15 days of initial trip payment)

- Plans: 1)Travel Basic and 2)Travel Select

TravelSafe Highlights

- Their Classic plan has hurricane warning coverage, which is better coverage for people traveling during hurricane season

- You can optionally cover pre-existing conditions if you purchase within 21 days of initial trip deposit

- Classic also has non-medical evacuation coverage, for things like natural disaster, civil, military or political unrest

- Plans: 1)Basic and 2)Classic