Knowing when to purchase single-trip insurance versus an annual travel insurance plan depends entirely on your travel plans. If you’re a last-minute traveler, you’ll likely only be purchasing single-trip coverage for those ad-hoc trips, but if you’re the kind of traveler who knows what trips you’ll be taking in advance, purchasing annual travel protection can save you a lot of money. Plus, having the same coverage all year long cuts down on purchasing the individual plans each time you make your reservations.

Knowing when to purchase single-trip insurance versus an annual travel insurance plan depends entirely on your travel plans. If you’re a last-minute traveler, you’ll likely only be purchasing single-trip coverage for those ad-hoc trips, but if you’re the kind of traveler who knows what trips you’ll be taking in advance, purchasing annual travel protection can save you a lot of money. Plus, having the same coverage all year long cuts down on purchasing the individual plans each time you make your reservations.

So, we decided to take two travelers we know and the trips they plan to take in 2012 and run the numbers to see whether it would be more cost-effective for them to purchase annual travel insurance.

Meet Sam and Sylvia

Our travelers: Sam and Sylvia are 53 and 50, respectively, and these are the trips they plan to take in 2012:

- A vacation in Bali, Indonesia for 20 days in May

- A 4-day getaway in New York, New York to attend their niece’s wedding in July

- A one-week visit to California to spend time with old college friends in September

- A pre-Christmas snow-shoeing adventure in Aspen in late November/December

- Sam and Sylvia are not planning to participate in any activities that could be labeled Hazardous (downhill skiing, mountaineering, SCUBA diving, etc.), so they don’t need to look for or add adventure travel insurance coverage to their plan.

- Sam and Sylvia are, however, taking one trip out of the country, where their at-home health insurance will not provide coverage, so they’ll need to have adequate travel health coverage.

- Sam and Sylvia will use their credit card to pay for their car rental, and so they don’t need extra car rental insurance. (They checked their credit card rental protection.)

The primary concerns Sam and Sylvia have are: medical protection and evacuation coverage.

Covering their trips with single-trip insurance

To ensure an apples-to-apples comparison with annual travel insurance, we did not selected trip cancellation coverage for any of these trips.

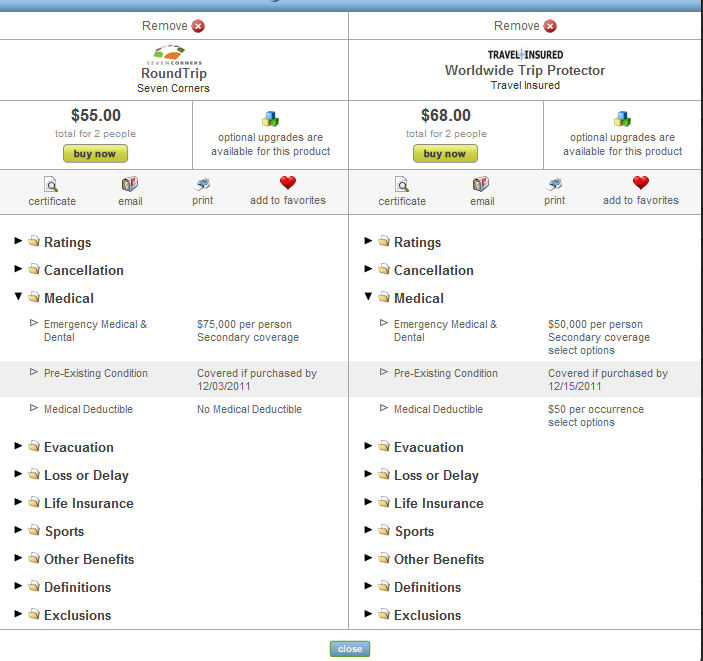

For Sam and Sylvia’s Bali trip, we found travel plans with at least $25,000 in medical coverage and at least $100,000 in evacuation coverage:

- RoundTrip from Seven Corners for $55 (total for two people)

- TraveLite from Travelex for $72 (total for two people)

- Advantage Bridge from MH Ross for $66.00 (for two people)

For their New York trip in July, their California trip in September, and their Aspen trip in November, we wanted at least $25,000 in medical coverage (because they would be out-of-network with their own health insurance plan, but still have coverage). Â We found plans with price ranges like these (which would apply to each of their trips, so multiply the price by three):

Let’s say our travelers like the RoundTrip plan and they’ll purchase that for their three U.S.-based trips, and they like the TravelEx plan for their Bali trip. Their travel insurance plans would be:

Bali – $72

New York – $55

California -Â Â $55

Aspen -Â Â $55

Total = $237

Covering their trips with annual travel insurance

It’s important to remember that with annual travel insurance, travelers do not get trip cancellation protection.

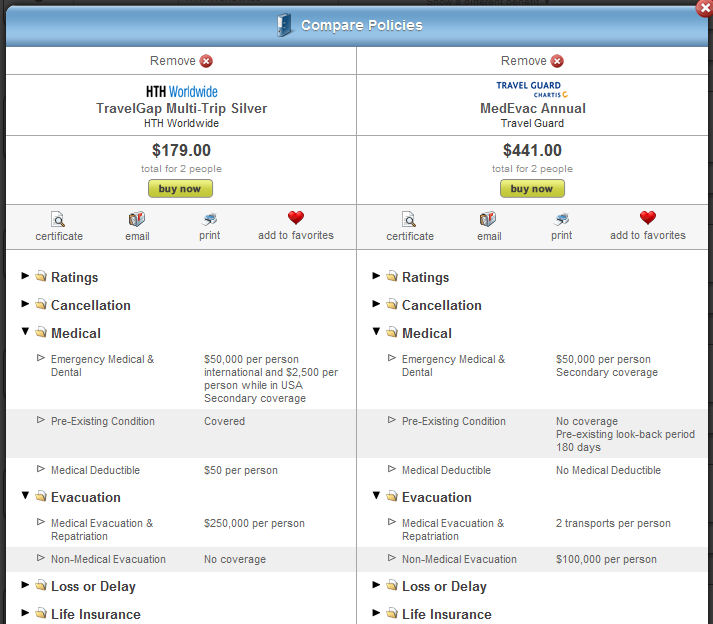

We ran our traveler’s details into the quote engine to see what they would pay for annual travel insurance and found these two plans:

The prices on these two plans are wildly different, but the coverage is different as well. Note that the Travel Guard plan includes up to $100,000 per person for non medical evacuations. So, if there is a non medical emergency Sam and Sylvia can have help getting to safety. There are other differences as well. Travel Guard includes up to 2 evacuations per person with their coverage, and the HTH plan delivers ups to $250,000 per person (which should be more than adequate – even for their Bali trip).

In this particular circumstance, Sam and Sylvia might find that purchasing the HTH Worldwide plan would be best for them. It would cover the trips they are planning to take, but for a price that totals to less than the individual coverage totals, it would also cover any surprise trips.

Of course, travel insurance is like any other insurance in that individual people purchase more or less based on their own circumstances and their comfort level. This is just a comparison, and your own numbers will vary.